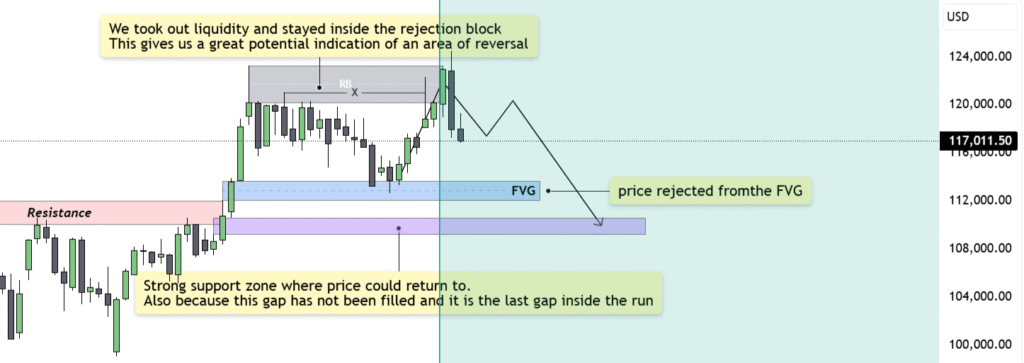

Market Overview

The daily chart’s price action has demonstrated a significant movement into a crucial rejection block after eliminating recent liquidity. This behavior is a typical indication of exhaustion in the ongoing trend, implying that momentum may soon begin to reverse. The daily close further supported this notion, clearly respecting higher-timeframe resistance levels.

Rejection Block Context

The 4H and daily rejection blocks have converged, forming a robust confluence zone where sellers have previously intervened. The price not only tested this area but also closed within it, which frequently suggests a high likelihood of reversal. This configuration enhances confidence that the market may be gearing up for a retracement.

Liquidity Sweep Confirmation

Prior to the rejection, the price surged through a cluster of resting liquidity above recent peaks. This liquidity sweep often serves as the catalyst for a reversal, as it ensnares late buyers and enables larger market participants to drive the price in the opposite direction.

Fair Value Gap Target

Beneath the current price, there exists an unfilled gap, which is the last gap within the ongoing movement. Historical price patterns indicate that such gaps typically get filled before a new move can materialize. This unfilled area presents a clear downside target.

Bearish Scenario

Should the rejection persist, I anticipate the price to gradually decline towards the 110k range, filling that remaining gap before any sustained bullish movement can recommence.

Conclusion

With liquidity absorbed, a definitive rejection from higher-timeframe resistance, and an unaddressed gap below, the chart is setting up for a potential retracement. I am monitoring for ongoing weakness to validate the move towards the 110k area.